Even if the REALTORS® are experienced, most servicers are under-staffed and still not adequately trained, making negotiating a short sale particularly difficult. Many REALTORS® are new to the short sales process a difficulty which is compounded by many lenders’ lack of sufficient and experienced staff to process short sales. The rapid increase in the number of short sales, and the short sales process itself present a number of challenges for REALTORS®. Major challenges include: As a result, homeowners may qualify for another mortgage sooner once they get back on their feet financially. Since a short sale generally costs the lender less than a foreclosure, it can be a viable way for a lender to minimize its losses.Ī short sale can also be the best option for a homeowners who are “upside down” on mortgages because a short sale may not hurt their credit history as much as a foreclosure. Why are the number of short sales rising? Due to the recent economic crisis, including rising unemployment, and drops in home prices in communities across the nation, the number of short sales is increasing. In some cases, the difference is forgiven by the lender, and in others the homeowner must make arrangements with the lender to settle the remainder of the debt. Posted in Uncategorized tagged lender, mortgage, short sale at 9:29 am by darganrealtyĪ short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. Source: McClatchy Tribune, Kate Forgach () Realtor Magazine Really talented real estate practitioners, contractors, and designers are available and eager for business. Besides the $8,000 first-time home buyer tax credit and the $6,500 move-up credit, there are an array of energy tax credits that can make home improvements pay off in cash.Ĥ.

Programs vary all over the country, but one good way to find them is to search online for “down-payment assistance programs” and the name of your region.ģ. While nothing-down loans have disappeared, it is easy to find down-payment assistance for lower-income and first-time home buyers. If they buy smartly, when prices come back up in a few years, they’ll be in better shape.Ģ. Because all property values are down, the sellers’ loss on a property is really only a paper loss because the next property they buy also will be a bargain.

Here are four factors that actually make this a good time to post a For-Sale sign.ġ. Selling a property in this tough market can seem like a challenge. Posted in Uncategorized at 8:56 am by darganrealty New home sales, however, unexpectedly slowed in January to the smallest pace since records began in 1963, and the supply of homes at the current sales rate rose to 9.1 months, the most since May 2009.” Today’s Local Market Conditions Report The S&P/Case-Shiller® national home price index rose for the third consecutive quarter in the fourth quarter, albeit at a slower rate, and the 20-city composite index showed an increase in December 2009 for the seventh month in a row six metropolitan areas experienced positive year-over-year growth, compared to four in November.

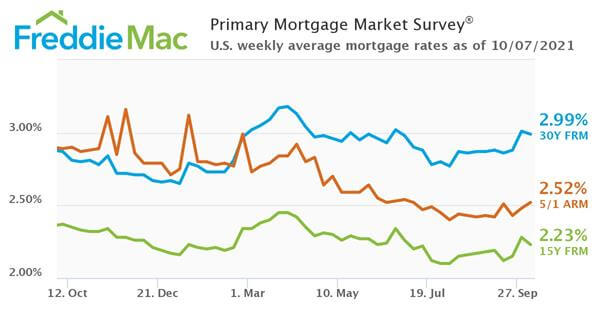

“There were also varying reports as to the current state of the housing market. “For instance, the January producer price index jumped well above the market consensus, but the consumer price index remained subdued and consumer confidence declined to the lowest level since April 2009, according to the Conference Board.” “Interest rates for 30-year fixed mortgages followed long-term bond yields higher and rose above 5 percent this week amid a mixed set of economic data reports” said Frank Nothaft, Freddie Mac vice president and chief economist. At this time last year, the 1-year ARM averaged 4.81 percent. The 1-year Treasury-indexed ARM averaged 4.15 percent this week with an average 0.6 point, down from last week when it averaged 4.23 percent. A year ago, the 5-year ARM averaged 5.06 percent. The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.16 percent this week, with an average 0.6 point, up from last week when it averaged 4.12 percent. A year ago at this time, the 15-year FRM averaged 4.68 percent. The 15-year FRM this week averaged 4.40 percent with an average 0.7 point, up from last week when it averaged 4.33 percent.

0 kommentar(er)

0 kommentar(er)